Malta

Residency By Investment

Second Passport Through Business and Real Estate Investment

Page Contents

Malta Permanent Residence Program

Malta is an exceptional destination for private residence seekers. With its stable political environment and strategic location boasting excellent air connectivity, it’s a prime choice for those seeking a European lifestyle. The Malta Permanent Residence Programme presents an enticing opportunity for non-Maltese individuals to secure a European residence permit, enabling visa-free travel within the Schengen Area.

Malta Overview

The Malta Permanent Residency Program (MPRP) is great for people who want to call Malta home without having to be there all the time. It is also a smart backup plan for those thinking about moving from their current country. Open to non-EU nationals and

their dependents, successful applicants gain a Maltese residence permit, making this program a great value for investors looking to settle in Malta permanently.

Investment Type

Property purchase of €375,000 or property lease of €14,000 per year

Processing Time

4 - 6 months from the submission of the application to the approval

Key Benefit

Visa-free travel to countries within the Schengen Area

Residency by Investment Malta

- Property Investment Option: Property purchase of €375,000 or property lease of €14,000 per month (€10,000 in South Malta or Gozo) for a minimum of 5 years.

- Capital Option: Ownership of capital assets valued at a minimum of €500,000, with at least €150,000 in non-cryptocurrency financial assets.

- Government Contribution: Contribution of €30,000 to the Maltese economy if the residential property is purchased or €60,000 if the property is leased. With a non-refundable administration fee of €40,000.

Family members eligible for a residency permit under the principal applicant:

- Spouse

- Children under 18

- Children over 18

- Parents and grandparents

- Indefinite right to reside in Malta (permanent residency certificate valid for a lifetime).

Get full guide about the process

Benefits of Malta Residency

Process

- Fast acquisition process: Takes 4-6 months to get Malta’s permanent residency by investment. The non-investment pathway requires you to live in Malta for at least 5 years.

- Permanent residency in Malta is granted for life. All you have to do is renew your residency card every 5 years.

Global Mobility

- Malta is a Schengen country. Its permanent residency permit allows visa-free entry into all 28 Schengen areas.

- The allowed period of stay in a Schengen area is 90 out of every 180.

Country Information

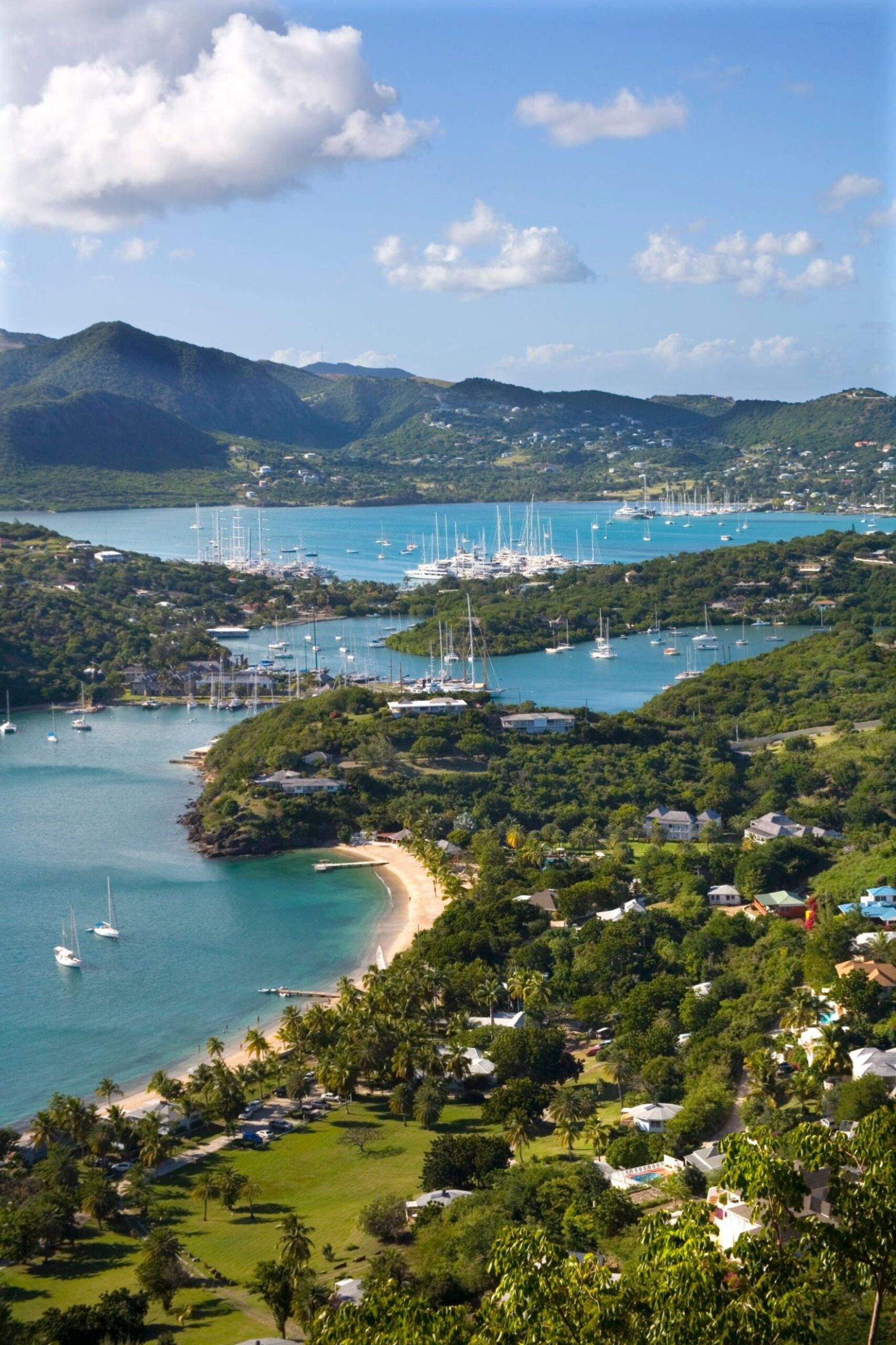

Malta is an archipelago in the Mediterranean. It is one of the smallest countries in the world, with a population of approximately 500,000 people.

Malta is a member of the Commonwealth of Nations. It joined the European Union in 2004, formed part of the Schengen Area in 2007 and became part of the Eurozone in 2008.

Malta offers residents and tourists exquisite beaches, secluded bays, beautiful architecture and rich culture.

Malta is recognized internationally as one of the safest and most secure places in the world with high economic and political stability, welcoming expatriates to its shores and embracing new residents with open hearts and minds.

Valletta is the capital of Malta, utilizing the EUR as its official currency, with an exchange rate of 1 USD to 0.89 EUR. The city has a population of 518,000 and operates under a Parliamentary Republic government system. Maltese and English are the predominant languages spoken in this vibrant Caribbean capital.

Get Your Second Passport

FAQs about Malta

Minimum contribution of €600,000 to the national development fund,

Additional dependents: €50,000 contribution per dependent

Further investment: €700,000 in residential real estate or €16,000 p.a. rental agreement (maintained for 5 years)

Mandatory donation: €10,000 to approved non-governmental organizations (philanthropic,

cultural, sport, scientific, animal welfare, or artistic)

EU country residence and 90-day visa-free travel within Schengen Area for 180 days

The first Malta residence permit is valid for a year, and the following ones are issued for two years each.

The holder must submit a tax return and pay the tax due by the end of April of the year following the reporting year. The tax office then sends confirmation of the payment, based on which the Identity Malta Agency replaces the residence permit card.

No, you don’t have to live in Malta. However, you cannot spend more than 183 days a year in another country.

No, you can’t. The programme doesn’t allow renting out or subleasingthe investment property

It is only possible if the investor chooses to buy a property rather than rent it. However, the investor can sell the property and return the money if they give up the residence permit.

Yes, you do. The investor becomes a Maltese tax resident when getting a residence permit underthe Malta Global Residence Programme

A special tax regime applies to the programme participants. They pay taxes under the following rates:

- 15% on the income earned abroad and transferred to Malta;

- 0% on global income not transferred to Malta;

- 35% on the income earned in Malta.

The minimum tax on the income earned abroad and transferred to Malta is €15,000 per annum. There are no additional taxes for family members. Investors do not pay inheritance tax.